For many US-based medical practices, medical billing outsourcing is viewed as a simple cost-cutting measure or a way to offload administrative tasks.

This perspective misses the fundamental strategic value. The most significant financial drain in a practice isn’t staff salaries; it’s the persistent, accepted revenue leakage caused by the inherent disconnect between clinical experts and the complex science of Revenue Cycle Management (RCM). A strategic outsourced partner like Derm Care Billing Consultants doesn’t just process claims; they diagnose and repair this disconnect, turning chronic underpayments and denials from an accepted ‘cost of doing business’ into a significant, recoverable asset.

The ‘Cost of Doing Business’ Fallacy: Uncovering the Hidden Financial Drain in Your Practice

Physicians and clinical staff are trained to deliver exceptional patient care, a mission that requires immense focus and dedication. The business of medicine, however, operates on a completely different set of rules dictated by insurance payers, government regulations, and intricate coding systems. This creates a critical knowledge gap. Physicians are not typically trained in Revenue Cycle Management (RCM) and consequently often relent to pressures and simply accept decreased reimbursements for their services, according to an analysis published in the Journal of Medical Practice Management.

This acceptance of revenue loss becomes institutionalized. A complex denial, a downcoded E/M service, or a bundled payment that seems slightly off is often written off as the unavoidable friction of dealing with payers. This isn’t friction; it’s a significant financial leak. The reality is that many of these losses are preventable and recoverable, but only with specialized expertise that a busy practice rarely possesses in-house.

This issue is compounded by the fact that billing errors often originate from systemic issues, not isolated mistakes. Research from the National Center for Biotechnology Information highlights that common reasons for inaccurate or inappropriate billing include a lack of formal education within residency curriculum and inadequate clinical documentation supporting the level of billing (NCBI). An in-house biller, even a dedicated one, may not have the training or authority to bridge this gap and provide corrective feedback to clinicians, perpetuating a cycle of errors and lost revenue.

Calculating the True Cost of In-House Billing (It’s More Than Just Salaries)

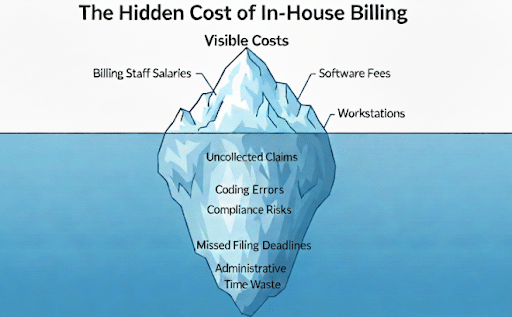

When considering in-house vs. outsourced medical billing pros and cons, practice owners often focus on the most visible expense: the salary and benefits of a billing specialist. This is a dangerously incomplete calculation. The true cost of managing billing internally is a combination of direct expenses, operational inefficiencies, and, most importantly, lost revenue.

The Hidden Financial Burdens

Beyond payroll, an in-house billing department carries significant hidden costs that erode a practice’s profitability:

- Persistent Revenue Loss: This is the largest hidden cost. It includes un-appealed claim denials, underpayments that are never challenged, missed filing deadlines, and incorrectly coded claims that leave money on the table. Without a dedicated team for outsourced AR follow-up in medical billing, aging claims quickly become uncollectible.

- Technology and Compliance Overhead: The costs of robust practice management and billing solutions, clearinghouse fees, software updates, and continuous staff training add up. Furthermore, maintaining strict HIPAA compliance in medical billing outsourcing is a complex, high-stakes responsibility that carries significant financial risk if managed improperly.

- Operational Drag: Every hour a physician, nurse, or practice manager spends dealing with a billing inquiry, a patient statement question, or a rejected claim is an hour not spent on patient care or practice growth initiatives. This administrative burden has a real, measurable impact on productivity and staff morale. As one of our partners shared, “The team at Derm Care Billing Consultants have not only saved our practice countless hours, they have saved us thousands of dollars. The billing/coding expertise of Derm Care Billing Consultants is above all others I have worked with.”

The High Price of Complexity

Not all claims are created equal. The financial drain of in-house management becomes particularly acute with complex cases. A study exploring healthcare administration costs found that the transaction cost for a complex medical claim can be $35 to $40, compared to $7 to $10 for a simple claim (JAMA Health Forum). An in-house team may lack the specialized knowledge or sheer bandwidth to manage these high-effort claims, leading them to be written off prematurely. This is especially true for specialty medical billing outsourcing services, where procedures and payer rules for areas like dermatology, cardiology, or podiatry require deep domain expertise to secure proper payment.

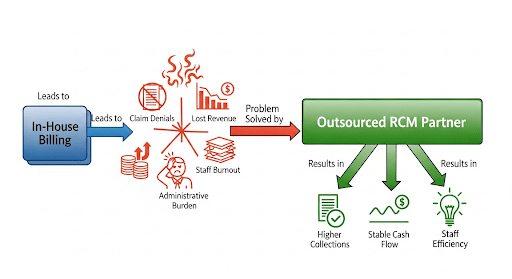

Strategic Outsourcing: More Than Just Offloading Tasks

The conversation around billing outsourcing needs to shift from a simple administrative decision to a core strategic one. Choosing an expert partner isn’t about finding someone to simply submit claims. It’s about hiring a team of financial analysts and process experts dedicated to optimizing every step of your revenue cycle. This is the difference between basic task-offloading and a true value-generating intervention.

From Task-Doer to Strategic Data Analyst

A premier RCM partner functions as a data analytics company for your practice. They don’t just see a denied claim; they see a data point. By aggregating data across thousands of claims, they identify patterns that an in-house biller would never spot:

- Which insurance carrier consistently downcodes a specific procedure?

- Is a particular front-desk staff member making frequent errors during patient eligibility verification?

- Does a certain clinician’s documentation consistently lack the specificity needed for higher-level coding?

This level of medical billing reporting and analytics bridges the critical gap between clinical activity and financial performance. The partner provides actionable feedback to the practice—on documentation, front-end processes, and coding—that prevents denials before they happen, directly improving cash flow with outsourced billing.

The Diagnostic Approach to Revenue Cycle Management

Top-tier healthcare revenue cycle management companies don’t apply a one-size-fits-all solution. They begin with a diagnostic process. Before implementing any new system, they conduct a thorough analysis of your entire end-to-end revenue cycle. This medical billing audit services outsourcing approach identifies the precise points of leakage.

Is the problem with outsourced prior authorization services? Is the charge entry process flawed? Are you losing money due to inefficient outsourced denial management services? By pinpointing the root causes, the solution becomes targeted and far more effective. This consultative approach is fundamental to finding a reliable medical billing partner who is invested in your long-term financial health, not just processing this month’s claims.

In-House vs. Outsourced Medical Billing: A Clear-Eyed Comparison

Understanding the trade-offs between maintaining an internal team and engaging a strategic partner is essential. Smaller practices, in particular, often struggle with this decision, as they, much like rural hospitals, often lack the ability to invest the financial or human resources needed to build and maintain an effective billing infrastructure internally (NCBI). Let’s break down the key factors.

Increased Collection Rates and Cash Flow

In-House Billing:

Performance is directly tied to the expertise and available time of one or two individuals. They may excel at routine claims but can become overwhelmed by a high volume of denials or complex appeals, leading to slower collections and a higher rate of write-offs. Cash flow can be inconsistent and unpredictable.

Strategic Outsourcing:

Leverages a team of specialists, including dedicated staff for AR follow-up and denial management. Their entire business model is built on maximizing your collections efficiently. This leads to a higher clean claim submission rate, faster payment velocity, and a significant reduction in days in accounts receivable, creating a more stable and predictable cash flow.

Access to Specialized Coding and Billing Expertise

In-House Billing:

Your practice’s expertise is limited to who you can hire and retain. Finding and keeping a certified, experienced coder who is an expert in your specific specialty (e.g., dermatology medical billing services or cardiology billing outsourcing) can be extremely difficult and expensive. Staff turnover can be catastrophic, bringing your entire revenue cycle to a halt.

Strategic Outsourcing:

You gain immediate access to a deep bench of certified professionals with expertise across multiple specialties, including complex areas like anesthesia billing or telehealth medical billing services. This team undergoes continuous training on the latest coding changes, payer policies, and government regulations, ensuring your practice remains compliant and fully reimbursed.

Reduction of Claim Denials and Underpayments

In-House Billing:

An in-house biller often wears many hats and may lack the time or specific knowledge to fight every denial aggressively. They may not recognize subtle underpayments or improper bundling by payers, allowing revenue to slip through the cracks.

Strategic Outsourcing:

A dedicated partner sees denial management as a core competency, not an afterthought. They use sophisticated technology and a deep understanding of payer tactics to appeal and overturn denials. Their focus is on maximizing payment for every service rendered, turning what was once lost revenue into captured income.

Decreased Administrative Burden on Clinical Staff

In-House Billing:

The practice manager and clinical staff are frequently pulled into billing issues, from answering patient questions about statements to chasing down documentation for appeals. This distracts from their primary roles of managing the practice and caring for patients.

Strategic Outsourcing:

The entire financial process is managed by the external partner. This frees your team to focus exclusively on patient care, operational efficiency, and growing the practice. The peace of mind this provides is invaluable. As another client noted, “Ever since, I do not have to worry-all bills are submitted on time, followed through, and the money due is collected… I sleep easier knowing Terry and his team have an eye on my receivables.”

Common Questions About Medical Billing Outsourcing Answered

Navigating the transition to an outsourced model often brings up several key questions. Here are clear answers to some of the most common inquiries from healthcare providers.

Q: How much does it cost to outsource medical billing?

The cost of outsourcing medical billing in the US typically follows one of a few models. The most common is a percentage of collections, where the billing company charges between 4% and 10% of the net revenue they collect on your behalf. This model is popular because it perfectly aligns the billing partner’s incentives with the practice’s: they only make money when you do. Other options include a flat fee per claim or a simple monthly retainer, though these are less common for full-service RCM. The exact rate depends on your specialty, claim volume, average reimbursement per claim, and the scope of services required (e.g., front-end RCM outsourcing services like credentialing vs. back-end medical billing outsourcing only).

Q: Can you outsource medical billing, and is coding included?

Yes, absolutely. Medical practices of all sizes, from solo practitioners to large group practices and hospitals, can and do outsource their billing and RCM. The question of whether medical coding is being outsourced is also a firm yes. In fact, expert medical coding outsourcing is a critical component of any reputable, complete medical billing solutions package. Accurate coding is the foundation of a clean claim and maximum reimbursement, so a high-quality partner will always have certified coders integrated into their team and process.

Q: How do US practices find and vet an outsourced billing partner?

This is a crucial question for practices wondering how to get medical billing outsourcing projects from the USA or, more accurately, how to select the right partner. The vetting process should be thorough. Practices should look for US-based medical billing services for small practices to ensure clear communication and alignment on compliance standards (onshore vs offshore medical billing is a major consideration). Key criteria include:

- Specialty-Specific Experience: Do they have a proven track record in your field, such as outsourced chiropractic billing services or outsourced mental health billing?

- Transparent Reporting: Can they provide clear, customizable reports on key performance indicators for medical billing (e.g., collection rate, days in AR, denial rate)?

- Technology Integration: Does their system seamlessly integrate with your existing EHR for a smooth workflow?

- Strong References: Will they provide testimonials or references from practices similar to yours?

- Compliance: Are they fully HIPAA compliant and can they demonstrate their security protocols?

Making the Right Choice for Your Needs

The decision to keep billing in-house or to outsource is not universal; it depends entirely on your practice’s specific circumstances, challenges, and goals. There is no single “best” answer, only the right fit for your unique situation.

For the Growth-Focused Physician-Owner

You see every dollar of revenue leakage as a direct barrier to profitability and expansion. For you, an in-house team might feel like a manageable cost center, but a strategic RCM partner should be viewed as a profit driver. Your ideal partner is one with robust medical billing reporting and analytics capabilities. You need a team that can not only increase practice revenue with outsourced billing but also provide the data-driven insights necessary to make informed decisions about service lines, payer contracts, and strategic growth.

For the Overwhelmed Practice Manager

Your daily reality is a struggle against the relentless complexities of claim denials, compliance updates, and patient inquiries. Your primary need is to stabilize finances, reduce chaos, and streamline operations. The right outsourced partner for you is one that functions as a true, reliable extension of your team. You should prioritize finding a company that offers exceptional communication, takes full ownership of the billing process, and demonstrably succeeds in reducing administrative burden in your medical practice, freeing you to focus on managing operations and supporting your clinical team.

For the New Practice Founder

You are starting with a blank slate and likely lack deep experience in the nuances of RCM. Building an entire billing infrastructure from scratch—hiring staff, selecting software, and establishing processes—is a massive, expensive, and risky undertaking. For you, an outsourced partner provides an immediate, end-to-end revenue cycle management outsourcing solution. Look for a partner offering comprehensive services that include critical startup tasks like medical credentialing and billing services. This allows you to launch your practice with a secure financial foundation and focus your energy on what matters most: building your patient base.

Ultimately, the right choice hinges on a careful evaluation of your practice’s unique goals, internal resources, and tolerance for financial risk. Optimizing your revenue cycle with outsourcing is a powerful strategy, but its success depends on finding a partner whose capabilities align perfectly with your needs.

For dermatology practices seeking a strategic partner dedicated to maximizing financial health and operational efficiency, Derm Care Billing Consultants in New York City, New York, offers a comprehensive analysis of your revenue cycle. Contact our expert team today for a personalized assessment to discover how we can turn your billing challenges into a competitive advantage.